Life Insurance

Basic Life and AD&D Insurance

Atlantic Packaging provides Basic Life and AD&D benefits to eligible employees at no cost to the employee. The life insurance benefit will be paid to your designated beneficiary in the event of death while covered under the plan. The AD&D benefit will be paid in the event of a loss of life or limb by accident while covered under the plan.

To file a Life Insurance claim, CLICK HERE.

| Lincoln Financial | ||

|---|---|---|

| Employee Basic Life & AD&D | ||

| Benefit Maximum | $50,000 | |

| Guaranteed Issue | $50,000 | |

Note: if your child is also an employee of Atlantic, then your child is not eligible for coverage as a dependent. If both parents are employees of Atlantic, only one parent may cover the child(ren) under the dependent life benefit.

Supplemental Life and AD&D Insurance

| Lincoln Financial | ||

|---|---|---|

| Employee Supplemental Life & AD&D | ||

| Benefit Increments | $1,000 | |

| Benefit Maximum | $500,000 | |

| Guaranteed Issue | $350,000 | |

| Spouse Supplemental Life & AD&D | ||

| Benefit Increments | $1,000 | |

| Benefit Maximum | 50% of Employee election or $250,000 | |

| Guaranteed Issue | $50,000 | |

| Dependent Supplemental Life & AD&D | ||

| Benefit Maximum | $20,000 | |

| Guaranteed Issue | $20,000 | |

In addition to the employer paid Basic Life and AD&D coverage, you have the option to purchase additional voluntary life insurance to cover any gaps in your existing coverage that may be a result of age reduction schedules, cost of living, existing financial obligations, etc. Your election, however, could be subject to medical questions and evidence of insurability.

You may purchase additional life insurance with Lincoln Financial if you want more coverage. Your contributions will depend on your age and the amount of coverage you elect.

All eligible employees have the option to purchase $1,000 increments to a maximum of $500,000. As a new hire, you can elect up to the lesser of 2x your annual earnings or $350,000 without providing evidence of insurability. The AD&D benefit must match the life benefit.

Employees also can elect life & AD&D insurance coverage on their spouse and dependents up to age 26. All eligible employees have the option to purchase $1,000 increments to the lesser of 50% of the employee life election or $250,000 on their spouse. As a new hire, you can elect $50,000 for your spouse without providing evidence of insurability. The AD&D benefit must match the life benefit.

Supplemental life and AD&D coverage for your dependents under the age of 26 can be selected for $20,000. The cost to insure your children is $2.90 per month or $0.67 per week. This cost is the same regardless of how many children you have.

You must elect coverage on yourself in order to elect coverage for your spouse and dependents.

Below is a chart of age banded rates per $1,000 of coverage for the employee and spouse life. The premium for supplemental spouse life insurance will be based on the employee’s age.

| Supplemental Life & Accidental Death and Dismemberment (AD&D) | ||||

|---|---|---|---|---|

| Rates per $1,000 | ||||

| Age | Weekly Rate | Monthly Rate | ||

| <30 | $0.014 | $0.06 | ||

| 30-34 | $0.014 | $0.06 | ||

| 35-39 | $0.026 | $0.11 | ||

| 40-44 | $0.028 | $0.12 | ||

| 45-49 | $0.037 | $0.16 | ||

| 50-54 | $0.037 | $0.16 | ||

| 55-59 | $0.104 | $0.45 | ||

| 60-64 | $0.134 | $0.58 | ||

| 65-69 | $0.254 | $1.10 | ||

| 70+ | $0.409 | $1.77 | ||

Note: if your child is also an employee of Atlantic, then your child is not eligible for coverage as a dependent. If both parents are employees of Atlantic, only one parent may cover the child(ren) under the dependent life benefit.

During open enrollment for the 2025-2026 plan year, new and current enrollees are eligible to elect or increase employee supplemental life up to the guaranteed issue limit of $350,000, without Evidence of Insurability. New and current enrollees are also eligible to elect or increase the spouse supplemental life insurance benefit up to the guaranteed issue limit of $50,000, without Evidence of Insurability

Outside of annual enrollment, EOI is required for any increase in coverage.

Beneficiary

Remember to keep your beneficiary updated for both the basic and supplemental life insurance, which can be done anytime throughout the year. If you are married and living in a community property state, your insurance carrier may require that you designate your spouse (or in some cases a registered domestic partner) for at least 50% of the benefit unless you have a waiver notice on file from your spouse. Consult your legal or tax advisor for further guidance on this issue. The beneficiary can be different between the basic and supplemental life insurance.

Why Do I Need Life Insurance?

Ask yourself this: In the event of my death, how would my family …

- Pay final expenses?

- Pay off debt?

- Pay for daily living expenses (housing, food, bills, etc.)?

- Replace Your Income?

- Maintain financial stability?

Voluntary Benefits

Supplemental Life, Disability, Accident, Critical Illness, Hospital Indemnity and Identity Theft Protection coverages are available to you, your spouse, and your dependent children. However, employees must have coverage in order for their spouse and children to obtain coverage.

Voluntary Benefits are just that, voluntary. The costs for voluntary benefits are 100% paid by the employee.

To file a claim for Life, Disability, Accident, Critical Illness, Hospital Indemnity. and/or Wellness Incentives, CLICK HERE.

Voluntary Short-Term Disability Insurance

This benefit covers 60% of your weekly base salary up to $2,000/week. The benefit begins after 7 days of injury or illness and lasts up to 12 weeks. Please see the summary plan description for complete plan details.

Short-Term Disability Premium Calculation Example:

Let’s assume an annual base salary of $30,000 for a 35-year-old employee as of 10/1.

1. $30,000 / 52 weeks = $576.92 weekly salary

2. $576.92 * .60 = $346.15 weekly benefit

Note: if your weekly benefit is more than the $2,000 weekly benefit maximum, use $2,000 to continue the calculations in step 3.

3. $346.15 / 10 (rate calculated based on $10 of weekly benefit) = $34.62

4. $34.62 x $0.0669 (age 35 weekly rate per chart) = $2.32 cost per week

| Short Term Disability | ||||

|---|---|---|---|---|

| Rates per $10 of Weekly Benefit | ||||

| Age | Weekly Rate | Monthly Rate | ||

| <29 | $0.074 | $0.32 | ||

| 30-39 | $0.067 | $0.29 | ||

| 40-44 | $0.069 | $0.30 | ||

| 45-49 | $0.076 | $0.33 | ||

| 50-54 | $0.092 | $0.40 | ||

| 55-59 | $0.127 | $0.55 | ||

| 60+ | $0.145 | $0.63 | ||

Voluntary Long-Term Disability Insurance

Long-term disability insurance provides income protection in the event you become unable to work due to a non-work-related illness or injury. This benefit covers 60% of your monthly base salary up to $10,000. Benefit payments begin after 90 days of disability. See Certificate of Coverage for benefit duration. Please see the summary plan description for complete plan details.

Long Term Disability Premium Calculation Example:

Let’s assume an annual base salary of $30,000 for a 35-year-old employee as of 10/1.

1. $30,000 / 12 months = $2,500 monthly salary

Note: if your monthly salary is more than $16,667, please use $16,667 to continue the calculations in step 2.

2. $2,500 / 100 (rate calculated based on $100 of monthly benefit) = $25

3. $25 x $0.0715 (age 35 weekly rate per chart) = $1.79 cost per week

| Long Term Disability | ||||

|---|---|---|---|---|

| Rates per $100 of Monthly Salary | ||||

| Age | Weekly Rate | Monthly Rate | ||

| <25 | $0.030 | $0.13 | ||

| 25-29 | $0.035 | $0.15 | ||

| 30-34 | $0.048 | $0.21 | ||

| 35-39 | $0.072 | $0.31 | ||

| 40-44 | $0.099 | $0.43 | ||

| 45-49 | $0.1567 | $0.68 | ||

| 50-54 | $0.222 | $0.96 | ||

| 55-59 | $0.279 | $1.21 | ||

| 60+ | $0.279 | $1.21 | ||

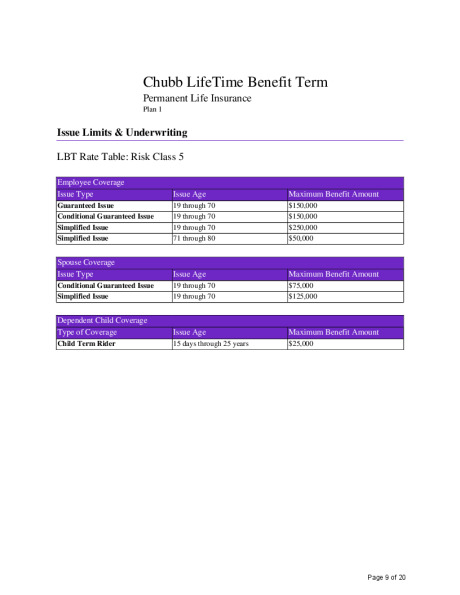

Lifetime Benefit Term

LifeTime Benefit Term helps protect you and your family if you were no longer able to provide for them. Your family can receive cash benefits paid directly to them upon your death that they can use to help cover expenses like mortgage payments, credit card debt, childcare, college tuition and other household expenses.

- Cash benefits can also be paid directly to you while you are living for long term care expenses.

- Includes a Long Term Care benefit rider

- Restoration of Death Benefit – restores your life coverage to not less than 50% of the death benefit on which your LTC benefits were based, not to exceed $50,000.

- Budget-Friendly Financial Security – Lifelong protection with premiums beginning as low as $3 per week.

- Dependable Guarantees – Guaranteed life insurance premium and death benefits last a lifetime.

- Highly Competitive Rates – For the same premium, LifeTime Benefit Term provides higher benefits than permanent life insurance and lasts to age 121

- Fully Portable and Guaranteed – Renewable for Life Your coverage cannot be cancelled as long as premiums are paid as due

- Family Coverage – Coverage is available for your spouse, children and dependent grandchildren

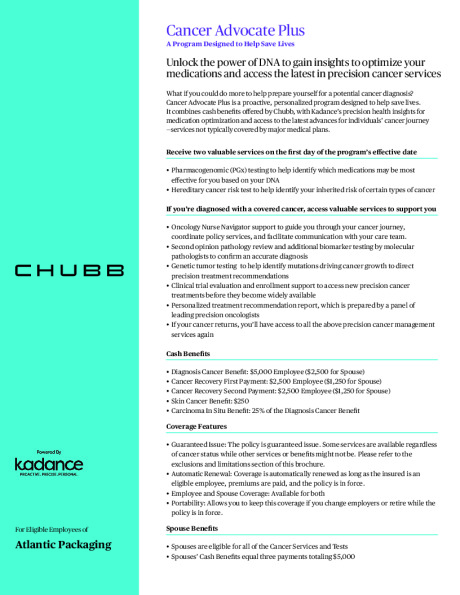

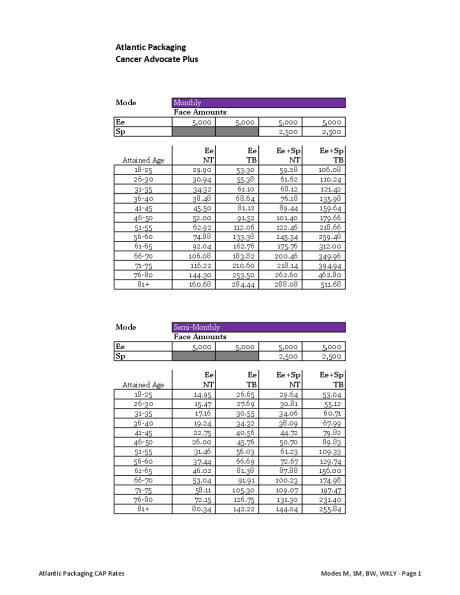

Cancer Advocate Plus

Cancer Advocate Plus is a proactive, personalized program designed to help save lives. It combines cash benefits with Kadance’s precision health insights for medication optimization and access to the latest advances for individuals’ cancer journey

Cash Benefits

- Diagnosis Cancer Benefit: $5,000 Employee ($2,500 for Spouse)

- Cancer Recovery First Payment: $2,500 Employee ($1,250 for Spouse)

- Cancer Recovery Second Payment: $2,500 Employee ($1,250 for Spouse)

- Skin Cancer Benefit: $250

- Carcinoma In Situ Benefit: 25% of the Diagnosis Cancer Benefit

Coverage Features

- Guaranteed Issue: The policy is guaranteed issue. Some services are available regardless of cancer status while other services or benefits might not be. Please refer to the exclusions and limitations section of this brochure.

- Automatic Renewal: Coverage is automatically renewed as long as the insured is an eligible employee, premiums are paid, and the policy is in force.

- Employee and Spouse Coverage: Available for both

- Portability: Allows you to keep this coverage if you change employers or retire while the policy is in force.

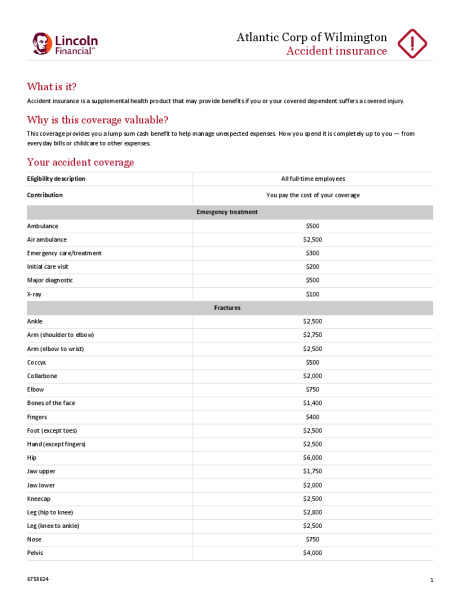

Voluntary Accident Insurance

Accident insurance pays you benefits for specific injuries and events resulting from a covered accident that occurs on or after your effective date. The benefit amount depends on the type of injury and care received.

Features include:

- Guaranteed Issue: no medical questions or tests are required

- Flexible: you can use the benefit payments for any purpose you like

- Portable: if you leave your current employer or retire, you can take your coverage with you.

- Includes a $75 wellness benefit for completing a health screening test

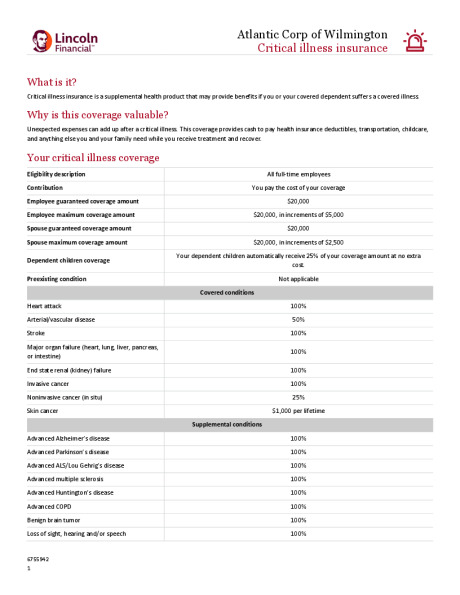

Voluntary Critical Illness Insurance

Critical illness insurance pays a lump-sum benefit if you are diagnosed with a covered illness or condition on or after your coverage effective date. Coverage is available for yourself and your eligible dependents.

Features include:

- Guaranteed Issue: no medical questions or tests are required

- Flexible: you can use the benefit payments for any purpose you like

- Portable: if you leave your current employer or retire, you can take your coverage with you.

- Includes a $75 wellness benefit for completing a health screening test

Voluntary Hospital Indemnity Insurance

Hospital indemnity insurance provides a fixed daily benefit payment if you have a covered stay in a hospital, critical care unit, or rehabilitation facility beginning on or after your coverage effective date.

Features include:

- Guaranteed Issue: no medical questions or tests are required

- Flexible: you can use the benefit payments for any purpose you like

- Portable: if you leave your current employer or retire, you can take your coverage with you.

- Includes a $75 wellness benefit for completing a health screening test

Voluntary Identity Theft Protection

Since so much of our daily life is now spent online, it’s more important than ever to stay connected. But more sharing online means more of your personal data may be at risk. In fact, 1 in 6 Americans were impacted by an identity crime in 2020.

Identity theft can happen to anyone. That’s why Atlantic offers Allstate Identity Protection as a benefit. So you can be prepared and help protect your identity and finances from a growing range of threats.

With Allstate Identity Protection Pro+, you get new and enhanced features designed to help you defend yourself from today’s risks.

| Employee Contributions | Pro+ | Pro+ Cyber | ||||

|---|---|---|---|---|---|---|

| Monthly | Weekly | Monthly | Weekly | |||

| Employee | $7.95 | $1.83 | $9.95 | $2.30 | ||

| Employee & Family | $13.95 | $3.22 | $17.95 | $4.14 | ||